Singapore has recently filed charges against two former bank relationship managers for their alleged involvement in a major money-laundering case worth S$3 billion ($2.3 billion). This marks the first criminal actions taken against finance professionals in this scandal.

The first individual, Wang Qiming, a 26-year-old Chinese national who previously worked at Citibank Singapore Ltd., was charged with 10 counts, including forging documents for the purpose of deceiving the bank. The charges were read out in a local state court, and Wang appeared in court wearing a white hooded sweatshirt, black pants, and white sneakers. He is currently out on bail and is expected to appear in court again in September.

The second individual, Liu Kai, a 35-year-old who was formerly with Bank Julius Baer & Co., was accused of assisting one of the convicted money launderers in submitting a forged Chinese tax document to aid in opening a bank account in Switzerland in November 2020. Liu, who holds Singapore permanent residency, declined to comment after the hearing and is also out on bail.

The money-laundering scandal initially led to arrests of wealthy foreigners in Singapore. Authorities have seized assets totaling about S$3 billion and have jailed ten people of Chinese origin for money laundering linked to overseas gambling operations. More individuals involved in the scheme are still at large.

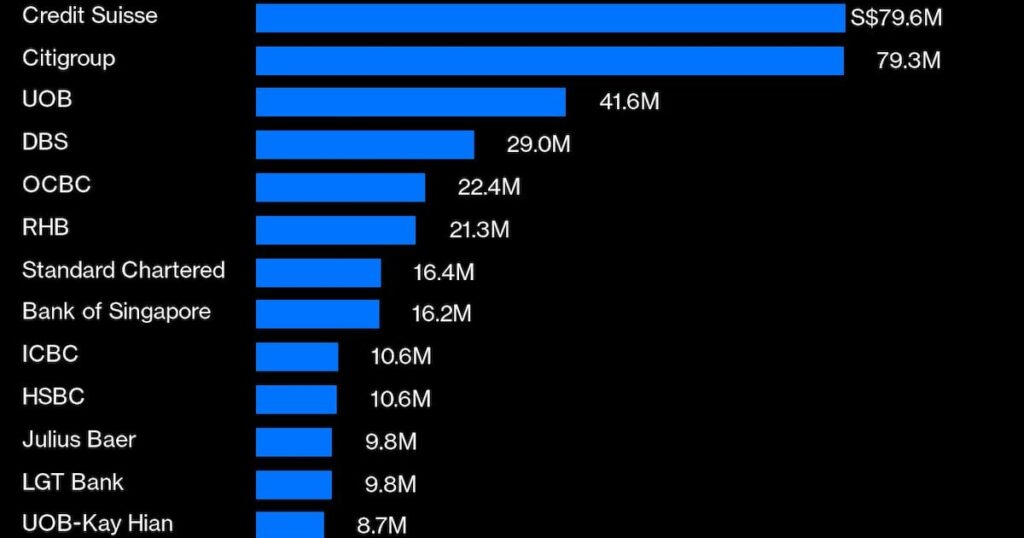

The case has had significant implications for Singapore’s banking sector, with court records showing that convicted individuals and their associates held substantial sums in deposits across various financial institutions in the country. The Monetary Authority of Singapore (MAS) has been conducting inspections on multiple banks, and those found to have significant dealings with criminals could face fines and other punitive measures.

MAS emphasized the importance of high standards of conduct from financial sector representatives and stated that those found guilty of breaking the law will be held accountable. Companies like Citigroup Inc. and UBS Group AG-owned Credit Suisse were among the banks holding significant deposits linked to the scandal.

Both Wang and Liu have been charged with various offenses, including aiding in money laundering activities. The maximum penalties for these offenses include jail terms of up to 10 years and fines. Citibank confirmed that Wang is no longer employed at the bank.

Additionally, a third individual, a 41-year-old Singapore citizen who was a driver to one of the suspects in the money laundering case, was also criminally charged. This individual was accused of assisting the suspect in disposing of luxury cars and providing false information to the police.

Ultimately, the legal actions being taken against these individuals highlight Singapore’s commitment to combatting money laundering and upholding the integrity of its financial system.