In the modern economy, rare earth elements (REEs) have become as essential as oil once was. These critical minerals are key components in everything from smartphones to electric vehicles to wind turbines. Yet, for years, one country has dominated the global supply of these vital materials: China. As geopolitical tensions rise and supply chain disruptions become increasingly common, countries worldwide, including Canada, are racing to secure their own sources of rare earths.

In this article, we’ll dive into the global rare earths race, how it’s creating opportunities for Canada’s junior miners, and why breaking China’s monopoly could be a game-changer for both the mining sector and global energy security.

Why Rare Earths Are So Critical

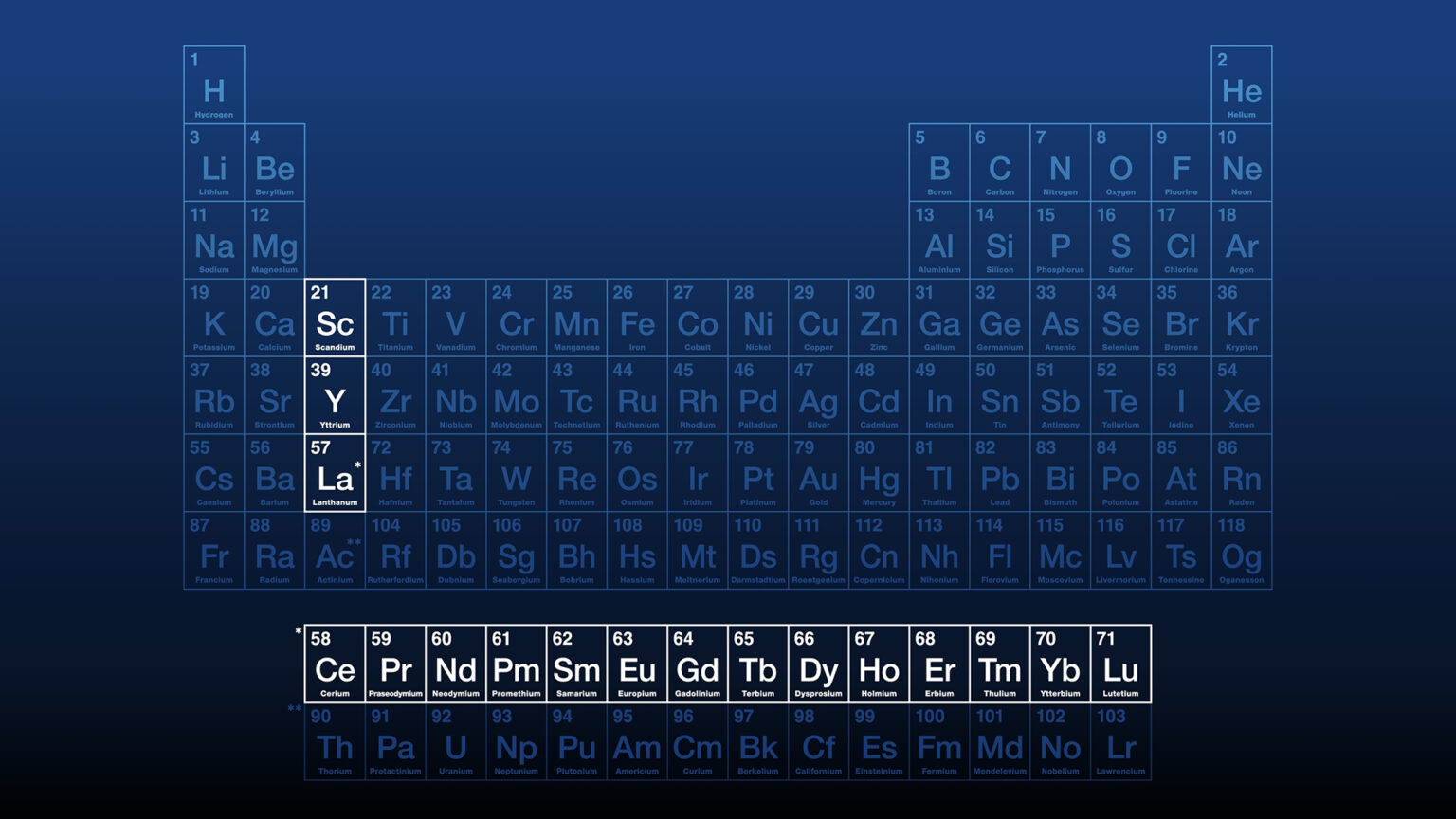

Rare earth elements consist of 17 minerals that are critical to the manufacturing of high-tech products and renewable energy technologies. Some of the most well-known include neodymium, dysprosium, praseodymium, and yttrium. These elements are crucial for producing powerful magnets used in electric vehicles, wind turbines, and military applications like guided missiles and fighter jets.

Despite their name, rare earth elements are not actually scarce; they are just challenging and expensive to mine and refine. As global demand for renewable energy and high-tech devices surges, so too does the demand for these critical minerals. However, the supply chain for rare earths has long been dominated by China, which controls approximately 80% of the world’s rare earth refining capacity.

Breaking China’s Rare Earth Monopoly: Why It Matters

China’s stranglehold on the rare earths supply chain has raised concerns among governments and industries worldwide. The ability of a single country to control such a vital supply of materials creates significant risks, particularly for nations pursuing aggressive decarbonization targets and looking to bolster their defense capabilities.

Several factors are driving efforts to break China’s rare earth monopoly:

- Geopolitical Risks: Rising tensions between China and the West, especially with the U.S. and its allies, have led to concerns about potential export restrictions or supply chain weaponization. In 2010, China temporarily restricted rare earth exports to Japan, highlighting the potential risks.

- Supply Chain Resilience: The COVID-19 pandemic exposed vulnerabilities in global supply chains, particularly for critical materials. Countries are now prioritizing building resilient supply chains to ensure they are not overly reliant on a single source, especially for materials essential to national security and clean energy technologies.

- The Clean Energy Transition: As countries strive to meet their climate goals, the demand for renewable energy technologies—such as wind turbines and electric vehicles—has skyrocketed. Rare earths are indispensable in the production of these technologies, making them a key part of the green energy revolution.

- Technological Advancements: New technologies like 5G networks, quantum computing, and advanced medical devices all require rare earths, further driving demand for these elements in a rapidly advancing global economy.

How Canada’s Junior Miners Are Leading the Charge

Canada, with its vast untapped mineral resources, is emerging as a critical player in the race to secure rare earth elements. The country has significant potential to become a reliable source of rare earths, with promising deposits found in provinces such as Quebec, Newfoundland, and Saskatchewan. Here’s how Canada’s junior miners are stepping up to the challenge:

1. Exploring Promising Rare Earth Deposits

Junior mining companies in Canada are making significant strides in exploring rare earth element deposits, particularly in the remote regions of northern Quebec, Labrador, and the Northwest Territories. These companies are targeting high-grade deposits that could help diversify global supply chains and reduce reliance on China.

Projects such as Appia Rare Earths & Uranium Corp.’s Alces Lake project in Saskatchewan and Defense Metals Corp.’s Wicheeda Rare Earth Element Project in British Columbia are generating buzz in the mining sector for their high-potential resources. Both companies are focused on developing domestic rare earth production capabilities, which could be crucial to supplying the global market with non-Chinese sources of critical minerals.

2. Government Support and Funding

Recognizing the importance of rare earths to national security and the green energy transition, the Canadian government has stepped up efforts to support exploration and production of critical minerals. In 2021, the Canadian government announced a $3.8 billion Critical Minerals Strategy, aimed at increasing the domestic production of rare earths and other critical minerals. This includes providing grants and loans to junior miners, streamlining regulatory approvals, and building infrastructure to support mining operations in remote areas.

Additionally, Canada is working closely with its allies, including the U.S. and the European Union, to create a coordinated approach to critical mineral supply chains. This collaboration ensures that Canada’s junior miners have the backing they need to develop their rare earth projects.

3. Focusing on Sustainable Mining Practices

Canada’s junior miners are positioning themselves as leaders in sustainable mining practices, a critical factor as ESG (Environmental, Social, and Governance) considerations become increasingly important to investors and end-users of rare earths. Many junior miners are adopting innovative extraction technologies that minimize environmental impacts, such as reducing water usage and preventing toxic chemical leakage.

For example, some companies are exploring the potential of biomining—using bacteria to extract rare earths from ore—while others are investing in recycling rare earth elements from electronic waste, creating a circular economy for these critical materials. Sustainable mining practices not only reduce environmental impacts but also appeal to ESG-conscious investors looking to support responsible projects.

Canadian Junior Rare Earth Miners to Watch

Several Canadian junior miners are emerging as leaders in the rare earth sector. Here are a few companies to keep an eye on as the rare earths race heats up:

- Appia Rare Earths & Uranium Corp. (API): Appia is actively exploring its Alces Lake project in Saskatchewan, which has shown promising high-grade rare earth elements, particularly neodymium and praseodymium—two key materials for permanent magnets used in EVs and wind turbines.

- Defense Metals Corp. (DEFN): Defense Metals is advancing its Wicheeda Rare Earth Element Project in British Columbia, which has significant potential to become a major supplier of rare earths outside of China. The project is focused on neodymium and praseodymium production.

- Vital Metals (VML): Vital Metals has begun rare earth production at its Nechalacho project in the Northwest Territories, making it Canada’s first rare earths producer. The company is focusing on sustainable extraction methods, positioning itself as a key supplier to global markets.

- Search Minerals (SMY): Search Minerals is advancing its Foxtrot and Deep Fox projects in Labrador, focusing on developing rare earth elements for the EV and renewable energy markets.

The Investment Opportunity: Tapping into the Rare Earths Boom

For investors, the global rare earths race presents a compelling opportunity, particularly through Canada’s junior mining sector. As demand for rare earths continues to grow, companies that successfully develop projects outside of China stand to benefit significantly from high prices and government-backed funding.

Moreover, the rare earths market is expected to expand rapidly in the coming years, driven by the green energy transition, technological advancements, and geopolitical pressures. Investors seeking exposure to critical minerals with long-term growth potential should keep a close eye on Canada’s junior rare earth miners.

Conclusion: Canada’s Junior Miners Are Set to Play a Key Role in the Rare Earths Race

The global race to secure rare earths is intensifying, and Canada’s junior miners are emerging as important players in this high-stakes competition. With significant deposits, government support, and a focus on sustainability, Canada is well-positioned to become a leading source of rare earth elements outside of China.

As demand for rare earths continues to soar—driven by the green energy revolution and the rise of high-tech industries—Canada’s junior miners offer a unique opportunity for investors looking to capitalize on the growing need for critical minerals. The rare earths race is on, and Canada’s mining sector is poised to help power the future.