As the world continues to pivot towards a green future, one sector is rapidly gaining prominence—electric vehicles (EVs) and battery technologies. With governments worldwide pushing for net-zero emissions targets, the demand for battery metals like lithium, cobalt, nickel, and copper has skyrocketed. This trend has ignited a modern-day “gold rush,” particularly benefiting junior mining companies in Canada, a country rich in these critical minerals.

This surge in battery demand presents a unique opportunity for Canadian junior miners, who are now emerging as key players in the global race for the resources needed to power the future. In this article, we’ll explore the connection between the global EV revolution, the rising demand for critical minerals, and how Canadian junior mining companies are positioned to thrive in this new era.

The EV Revolution and Its Impact on Global Mineral Demand

The electric vehicle market is experiencing explosive growth. According to the International Energy Agency (IEA), global sales of EVs are expected to reach 14 million units in 2024, a 35% increase from the previous year. As a result, the demand for batteries has reached an all-time high, creating a ripple effect across industries reliant on critical minerals.

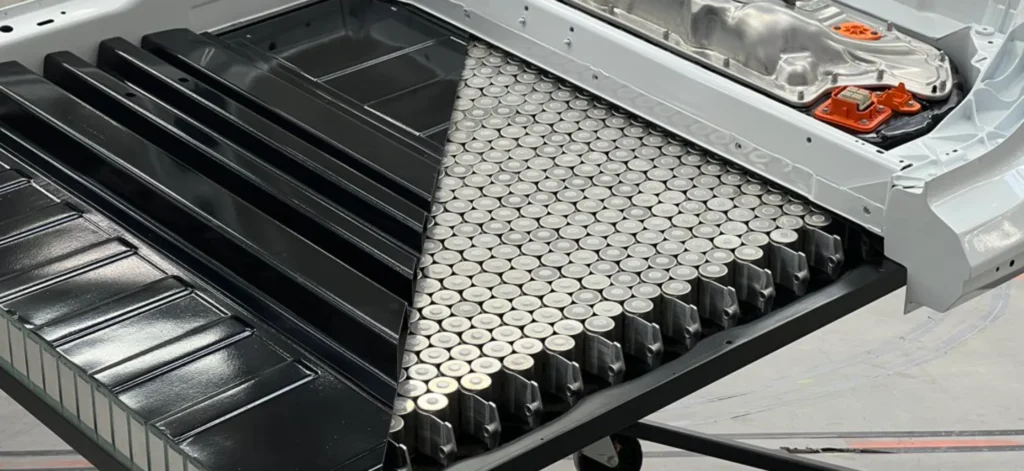

Battery metals such as lithium, cobalt, nickel, and copper are essential components of modern EV batteries. These materials are not just limited to EVs; they are also critical in the production of renewable energy storage systems, mobile devices, and various industrial applications. As global efforts to decarbonize the economy accelerate, the demand for these metals is expected to grow exponentially.

How Canada’s Junior Mining Sector Stands to Benefit

Canada is one of the top countries globally in terms of mineral production, and the nation’s junior mining companies are playing a pivotal role in discovering and developing critical mineral resources. Here are a few ways in which rising battery demand is creating opportunities for these miners:

1. Exploration and New Discoveries

With global automakers like Tesla, Ford, and General Motors scrambling to secure stable supplies of battery metals, exploration activity in Canada has intensified. Junior mining companies, which typically focus on early-stage exploration, are venturing into previously unexplored regions in search of lithium-rich pegmatites, nickel-cobalt deposits, and high-grade copper ores. Provinces like Quebec, Ontario, and British Columbia have become hotbeds for new discoveries, fueling optimism in the sector.

For example, the James Bay region of Quebec has seen a spike in exploration for lithium and other battery metals, with several juniors reporting promising results. The increased investment in exploration could lead to the discovery of new world-class deposits, propelling Canadian juniors to the forefront of the battery metals supply chain.

2. Strategic Partnerships and Investments

Junior mining companies often face challenges when it comes to securing funding for exploration and development. However, the surge in demand for battery metals has caught the attention of institutional investors, automakers, and governments alike. In recent years, we’ve seen major automakers partner with junior miners to ensure long-term access to critical minerals.

In Canada, there has been a rise in strategic partnerships between juniors and international players. Companies like Stellantis and Volkswagen have invested heavily in securing supply chains by partnering with exploration-focused miners. Such deals provide juniors with the financial backing they need to accelerate development, while also offering a potential exit strategy through acquisitions.

3. Government Support for Critical Minerals

Recognizing the importance of securing domestic supply chains for critical minerals, the Canadian government has stepped up its support for the mining sector. In 2023, the federal government announced a $3.8 billion Critical Minerals Strategy, aimed at boosting exploration, production, and processing of key battery metals.

This initiative provides funding for junior miners working on critical mineral projects, offering tax incentives, grants, and streamlined regulatory processes. Such measures are designed to bolster Canada’s position as a global leader in the supply of EV-related materials, which in turn supports the growth of the junior mining sector.

The Challenges Ahead

Despite the positive outlook, the road ahead is not without challenges. Many junior mining companies still face significant hurdles in raising capital, navigating environmental regulations, and developing infrastructure in remote areas. Additionally, as the demand for critical minerals grows, supply chains are becoming increasingly competitive, making it essential for Canadian juniors to secure strategic partners and investors early in the game.

Environmental and social responsibility are also key concerns. Mining operations, particularly those in sensitive ecological regions, must navigate stricter regulations and increasing scrutiny from environmental groups. To remain competitive and attractive to investors, Canadian juniors must prioritize sustainable mining practices and community engagement.

Why This Matters for Investors

For investors, the rising demand for battery metals represents a significant opportunity to gain exposure to the green energy transition. Canadian junior mining companies offer high-risk, high-reward potential, particularly those focused on lithium, cobalt, nickel, and copper exploration. With the right mix of exploration success, strategic partnerships, and government support, these juniors could deliver significant returns in the coming years.

In addition to EVs and batteries, demand for critical minerals is expected to remain robust due to the broader push towards renewable energy sources such as wind and solar power, both of which require vast amounts of copper and other materials. As the world moves toward a net-zero future, the need for sustainable and reliable sources of critical minerals will only intensify, placing Canada’s junior miners in a favorable position.

Conclusion: The Future is Bright for Canadian Junior Mining

The global shift towards electric vehicles and renewable energy is reshaping industries, creating new opportunities for Canadian junior mining companies. As the demand for battery metals continues to soar, juniors are well-positioned to benefit from increased exploration activity, strategic partnerships, and government support.

For investors, this is an exciting time to consider exposure to Canadian juniors, particularly those engaged in the exploration and development of critical minerals. With a strong foundation in place, Canada’s junior mining sector stands to play a crucial role in the world’s green energy transition—ushering in a new era of growth and prosperity for the industry.