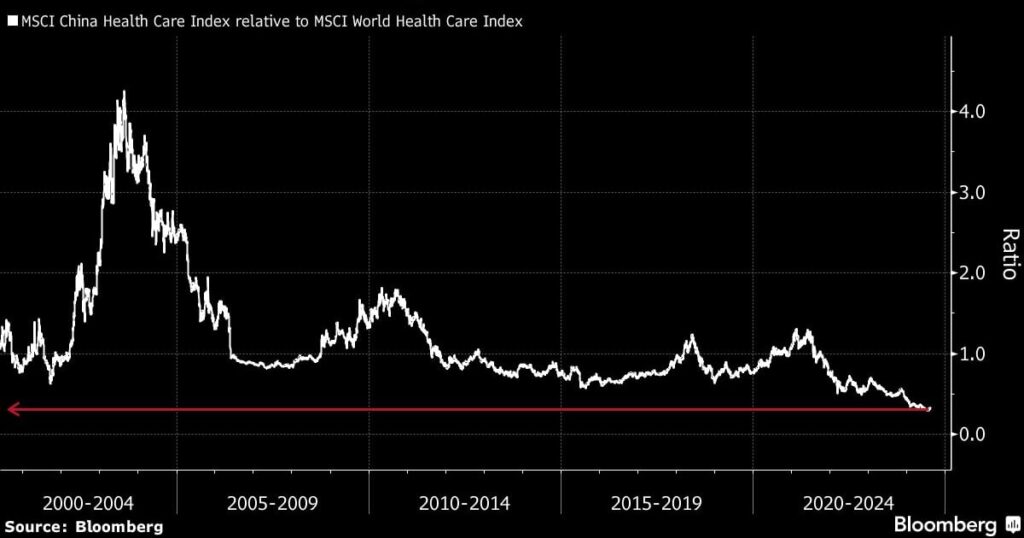

A shift towards defensive shares, combined with supportive government policies, is driving a resurgence in the attractiveness of underperforming Chinese health-care stocks. The MSCI China Health Care Index saw a significant 23% decline this year, but signs of improved sentiment are now emerging. Recent measures implemented by Beijing to bolster the sector, along with expectations of Federal Reserve interest-rate cuts, provide potential for a rebound as the index trades near a record low in comparison to global peers.

“We maintain a positive outlook on quality players in specific sub-sectors such as medical equipment and drug innovation within the China health-care industry,” stated Jim Jiang, Asian equities investment manager at abrdn.

A tentative recovery in China’s health-care shares began in July, as investors sought out undervalued segments of the stock index, leading to the outperformance of MSCI’s China health sub-gauge compared to its broader benchmark. This turnaround followed concerns over the US Biosecure Act and Beijing’s extensive anti-corruption crackdown, which had previously caused a prolonged slump in the sector.

Morgan Stanley analysts, led by Sean Wu, have expressed growing optimism towards pharmaceutical companies. The brokerage firm favors Shanghai United Imaging Healthcare Co. and Shenzhen Mindray Bio-Medical Electronics Co. in the medical technology sector for their strong sales exposure in equipment replacement, as well as Alibaba Health Information Technology Ltd. in the Internet health category.

The recent outbreak of mpox adds another layer of complexity to investors, as they evaluate which sector players are best positioned to respond to the anticipated increase in demand. As a result, shares of certain Chinese virus detection kit manufacturers, such as Daan Gene Co, saw a rise on Thursday following the World Health Organization’s declaration of a global health emergency in Africa.

In response to the challenges faced by health-care firms struggling with funding constraints, China has been introducing supportive policies. Initiatives like a pilot program aimed at streamlining the clinical trial process for certain drugs and measures to stimulate domestic biotech innovation have been put into action by the central government. These efforts are expected to rejuvenate drug development activities and investments in the sector.

Furthermore, the easing of Fed policies is set to bolster the health-care sector, as the performance of biotech and health shares typically shows an inverse correlation to US interest rates, according to Deutsche Bank AG. Analysts anticipate a positive sentiment for the health-care sector in the second half of the year, as the Fed is expected to implement a more aggressive rate-cutting strategy.

Despite these potential opportunities, Chinese health stocks still face obstacles, including uncertainties surrounding the Biosecure Act and a lack of exposure to blockbuster weight-loss drug producers. However, there is growing investment in innovative drugs in China, leading to the possibility that Chinese players may eventually develop similar products as their international counterparts.

Overall, the Chinese health-care sector is experiencing a resurgence driven by supportive government policies and an improving global outlook, despite the challenges that lie ahead.