The Toronto Stock Exchange (TSX) has shown signs of recovery, reaching pre-selloff levels after the recent market turbulence. Investors are closely monitoring TSX-listed stocks that have experienced setbacks but are striving to regain their previous momentum.

These companies have been making headlines with their recent developments, prompting the question of whether they will successfully turn things around.

Tilray Brands Inc., listed on the TSX, has been making strategic moves to strengthen its position in the craft beer market. A recent acquisition agreement with Molson Coors has allowed Tilray to expand its beer portfolio, potentially leading to substantial revenue growth.

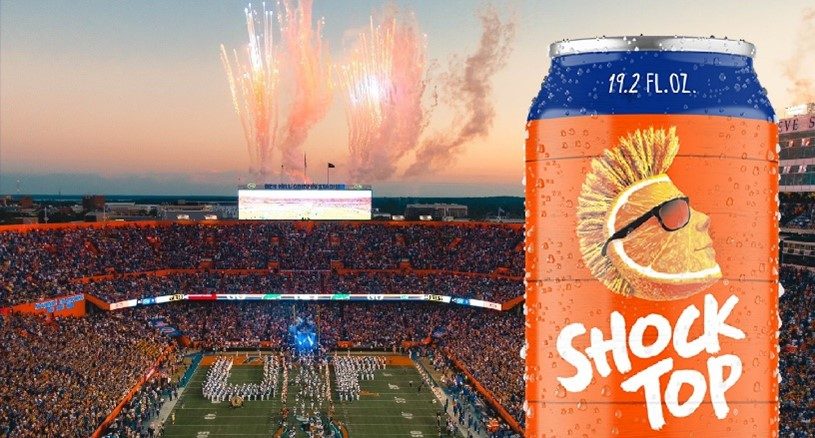

Additionally, Tilray’s subsidiary, Shock Top, secured a groundbreaking partnership with the University of Florida Athletic Department, introducing a co-branded craft beer for Gators fans. This initiative aims to enhance brand visibility and customer engagement in the craft beer sector.

Quarterhill Inc., a key player in tolling and transportation technology, reported positive cash flow in Q2 2024, marking a significant turnaround after two years. Despite challenges in profitability, such as a drop in gross profit, Quarterhill’s acquisition of Red Fox signals its commitment to expanding software offerings for future growth.

However, Victoria Gold Corp. is facing environmental concerns following a cyanide solution spill at its Eagle mine in Yukon Territory. The Yukon government has taken action against the company, highlighting the need for mitigation efforts to address environmental damage and restore investor confidence.

As the TSX continues its recovery, the performance of individual stocks like Tilray, Quarterhill, and Victoria Gold will be crucial for investors. Staying informed, monitoring market developments, and conducting thorough due diligence are essential for maintaining a resilient investment portfolio in an evolving market landscape.