Victoria Gold, a miner based in Yukon, will be liquidating its assets and selling them to the highest bidder following a significant cyanide solution spill at its Eagle gold mine on June 24. This decision was made by the Ontario Superior Court of Justice, which appointed PricewaterhouseCoopers to oversee the management of the company’s property, assets, and operations on behalf of creditors.

The Government of Yukon has expressed a lack of confidence in Victoria Gold Corporation’s management team due to their perceived lack of urgency in addressing the environmental and safety concerns arising from the spill. The company’s stock has plummeted by 93.54% since the incident.

The receiver appointed by the court is tasked with restoring contaminated waterways and protecting affected wildlife, which may involve extensive environmental mitigation efforts given the scale of the spill. Despite Victoria Gold’s opposition to the receivership, the TSX is expected to suspend its shares and initiate a review for delisting.

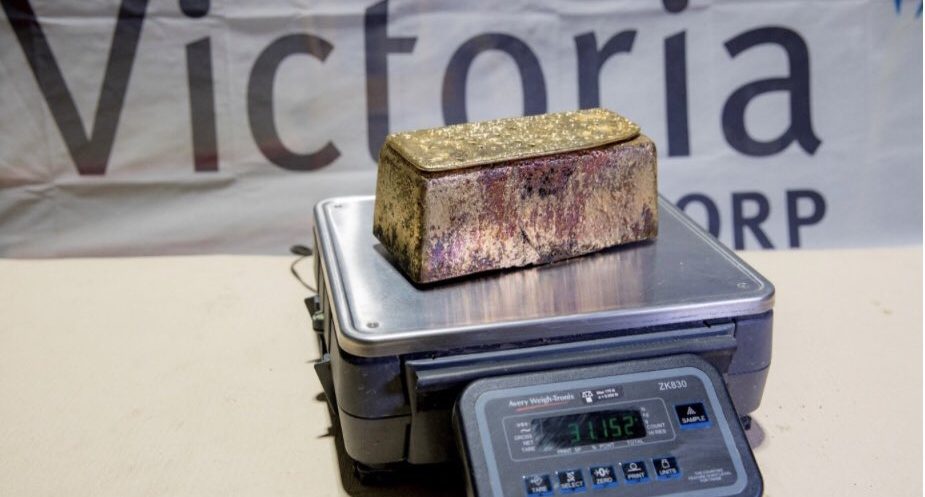

As of December 31, the Eagle mine held significant gold resources and reserves, valuing nearly US$17 billion at current spot prices. The mine’s production in 2023 and Q1 2024 generated notable cash flow, contributing to the company’s profitability over the past four years.

Victoria Gold is known for its focus on mineral exploration and production in Yukon. The company’s stock price has experienced a sharp decline since the spill, trading at C$0.48 per share. For more information or discussion on the matter, interested parties can visit the Victoria Gold Corp. Bullboard or Stockhouse’s stock forums and message boards.

Please note that the content shared in this article is for informational purposes only and should not be construed as investment advice. For a comprehensive disclaimer, please refer to the provided link.