Despite a significant drop in lithium prices due to overproduction, declining EV sales, and government subsidies, the International Energy Agency projects a tenfold increase in demand for lithium by 2050 driven by the EV and battery markets. This long-term growth outlook supports investment in lithium stocks.

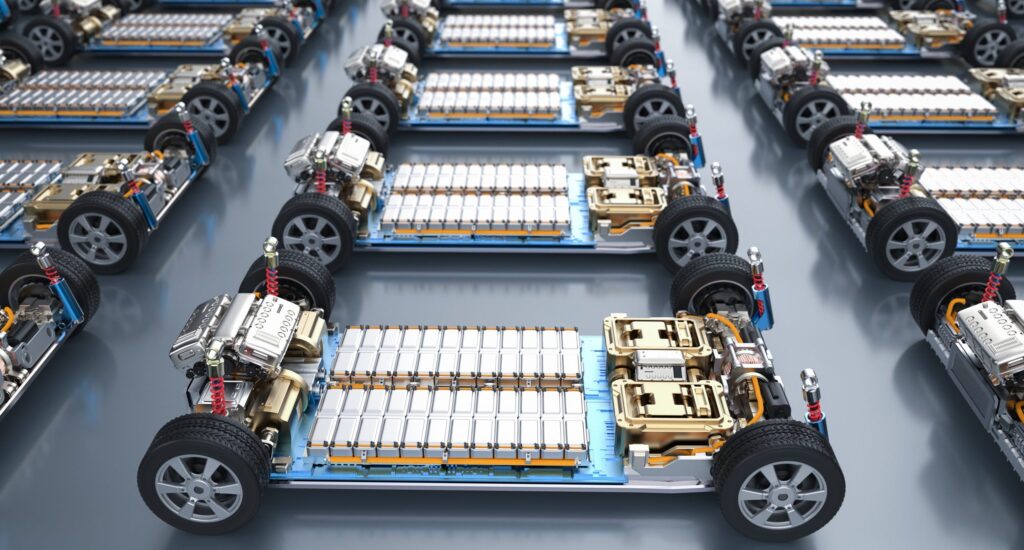

The global lithium battery market is anticipated to exceed US$180 billion by 2032, with a compound annual growth rate of over 14%, outperforming the S&P 500. Current lithium demand stands at 250,000-300,000 tons of lithium carbonate equivalent per year, accounting for half of the world’s total lithium supply in 2021.

Various sources, including Nature, Sprott, and BloombergNEF, advocate for the long-term potential of lithium stocks. Catalysts for long-term investment in lithium stocks include initiatives to reduce China’s dominance in lithium refining, benefiting from tariffs on Chinese-made EVs, depressed stock prices, leadership in low-cost production, and advancements in recycling and extraction technologies.

While global fossil fuel consumption remains high, the imperative to address climate change underscores the importance of investing in lithium resources. This provides investors with opportunities to capitalize on short-term market fluctuations and enhance long-term returns through diligent research.

Investors interested in lithium stocks can explore top Canadian lithium stocks and engage in discussions on Stockhouse’s forums. It is essential to conduct thorough due diligence before making investment decisions. This information is for educational purposes and should not be construed as investment advice.